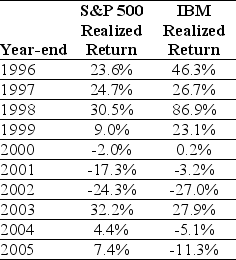

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for the S&P 500 is 11.7%,and the standard deviation of returns is 20.5%.Based on these numbers,what is a 67% confidence interval for 2010 returns?

Definitions:

Average Total Cost

The total cost of production divided by the number of goods produced, showing the average cost per unit.

Raw Materials

The basic, unprocessed materials used in manufacturing or production processes.

Trademarks

Legal designations that protect brand names, logos, and other distinctive signs to distinguish goods or services.

R&D Expenditures

Funds allocated by businesses, governments, or other organizations towards research and development in order to innovate and create new products or improve existing ones.

Q7: A levered firm is one that has

Q11: The costs of external financing must be

Q20: Why do most people launching a start-up

Q50: Valence Electronics has 217 million shares outstanding.It

Q51: Shown above is information from FINRA regarding

Q71: Refer to the information above.Without issuing the

Q78: Von Bora Corporation (VBC)is expected to pay

Q80: The following show four mutually exclusive investments.Which

Q85: A maker of kitchenware is planning on

Q90: What do you understand by break-even analysis?