Use the table for the question(s) below.

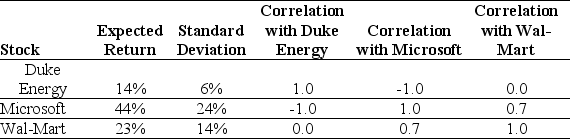

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Horizontal Lines

Lines that are parallel to the horizon or ground level, often used in graphics or design to imply stability or calm.

Inflated GPA

A grade point average that is considered to be artificially high, often due to lenient grading policies or non-academic factors.

False Language Proficiency

Misrepresented or exaggerated skills in comprehending or communicating in a language.

Incorrect Salary History

Refers to inaccuracies or disparities in the salary information provided by an applicant or employer, which may raise questions during the hiring process.

Q3: Which of the following investments offered the

Q5: The average annual return over the period

Q9: A brewer is launching a new product::

Q10: What is the capital structure of a

Q48: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1618/.jpg" alt=" Felicity Industries is

Q70: Power Financial Corp has a current share

Q73: The price of a call option on

Q83: The expected return is usually _ the

Q89: A protective put written on a portfolio

Q102: Hargrave Kitchen & Bath has 6 million