Use the table for the question(s) below.

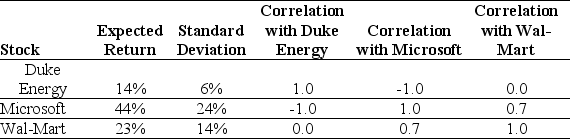

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is consists of a long position of $10,000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Communication Channel

The medium through which information is transmitted from sender to receiver, such as email, phone, or face-to-face.

Customer Complaints

Feedback from customers expressing dissatisfaction with a product or service.

Free Consulting

Offering professional advice without charge, often as a way to introduce services or gain trust.

Indirect Method

A technique that subtly conveys messages or arrives at conclusions, often used in communication or financial statements.

Q9: You are trying to decide between three

Q26: What diversification,if any,is achieved if two stocks

Q28: You have an investment opportunity that will

Q32: Your portfolio has 25% of its value

Q35: The Ontario Teachers' Pension Plan is a

Q45: A firm has $50 million of common

Q63: Panjandrum Industries,a manufacturer of industrial piping,is evaluating

Q67: An all-equity firm produced a dividend flow

Q92: A firm has $3 million market value

Q102: The free cash flow for the last