Use the table for the question(s) below.

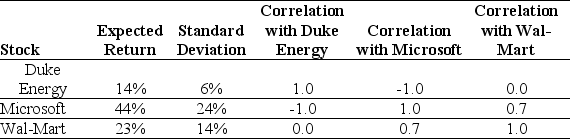

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to:

Definitions:

Average Revenue

The amount of income generated per unit of sale or services rendered, calculated by dividing the total revenue by the number of units sold.

Total Revenue

The overall amount of money generated by a firm from selling its products or services, calculated as the quantity of goods sold multiplied by the price of the goods.

Perfectly Elastic

A situation where a small change in price leads to an infinite change in quantity demanded or supplied, depicted as a horizontal line on a graph.

Perfectly Inelastic

A situation in which the quantity demanded or supplied does not change regardless of changes in price.

Q23: When would it make sense for a

Q31: Suppose you invested $33 in Pfizer one

Q42: Why does the option to abandon a

Q53: Fanshaw Corporation is expected to pay an

Q69: A firm reports that in a certain

Q69: Net present value (NPV)is the difference between

Q72: In general,it is possible to eliminate _

Q78: Von Bora Corporation (VBC)is expected to pay

Q81: What is the decision criteria while using

Q85: Which of the following is a typical