Use the table for the question(s) below.

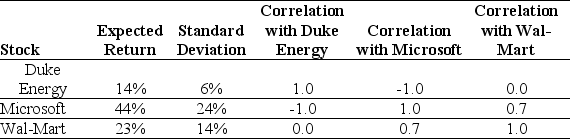

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to:

Definitions:

Innovators

Individuals or entities that introduce new ideas, products, or methods, leading to change or progress.

Unemployment Rate

The unemployment rate represents the proportion of the workforce that is without a job and actively looking for work.

Guns Production

The manufacture of firearms and related materials, often considered in discussions of military spending or gun control policies.

Butter Production

The process of turning cream into butter, typically through churning, forming a solid dairy product used in various cuisines.

Q2: According to Graham and Harvey's 2001 survey

Q13: The amount that Ford Motor Company owes

Q18: Explain why investors do not receive a

Q53: Melissa founded her company using $100,000 of

Q53: Visby Rides,a livery car company,is considering buying

Q73: Assume that THSI's cost of capital for

Q88: Standard stock options are traded and bought

Q99: A construction company spends $1.4 million to

Q110: How is equity like a call option

Q113: You have an investment opportunity in the