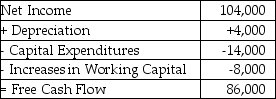

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 6% per year.If Monroe were able to reduce its annual increase in working capital by 15% without affecting any other part of the business adversely,what would be the effect of this reduction on Monroe's value,given a cost of capital of 11%?

Definitions:

Small Retailers

Independent or local retail businesses that operate on a smaller scale compared to large chains, focusing on a specific market segment or community.

Q6: What are callable bonds?

Q7: Matt's Machine Company has borrowed $10 million

Q11: Pembina Properties issues commercial paper with a

Q20: A firm requires an investment of $20,000

Q35: Suppose Blank Company has only one project,as

Q58: The date on which a firm pays

Q62: What is a call provision?<br>A) the periodic

Q107: What is moral hazard?

Q108: Why do firms prefer forward contracts rather

Q124: Given the following data for a given