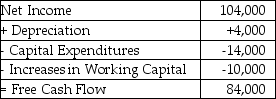

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 4% per year.and has a cost of capital of 8%.Monroe wishes to achieve a 5% increase in firm value.If the rest of the business remains unchanged,what reduction in working capital increases would Monroe require in order to achieve this goal?

Definitions:

Auditory Hallucinations

Experiences involving hearing sounds—most commonly voices—that are not present in the external environment.

Muscle Spasms

Involuntary contractions of a muscle or group of muscles, often causing pain or discomfort.

Evolutionary Psychologists

Specialists in psychology who focus on how evolution has shaped the mind and behavior over millennia.

Genetic Predispositions

Inherent tendencies toward certain traits or conditions based on one's genetic makeup, influencing susceptibility to diseases, behaviors, and more.

Q24: Why should permanent working capital be financed

Q30: A(n)_ capital market is one where all

Q38: Using the covered interest parity condition,the calculated

Q41: In general,the gain to investors from the

Q43: A company has a current tax rate

Q74: Why does a floating lien agreement have

Q76: Which of the following statements regarding bonds

Q81: Luther's Accounts Payable days is closest to:<br>A)

Q84: Insurance companies diversify their risks by pooling

Q97: What is a cash-and-carry strategy?