Use the information for the question(s) below.

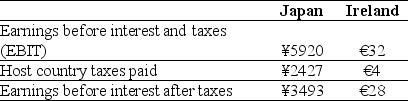

KT Enterprises,a Canadian import-export trading company,is considering its international tax situation.Currently KT's Canadian tax rate is 35%.KT has significant operations in both Japan and Ireland.In Japan,the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-After the Japanese taxes are paid,the amount of the earnings before interest and after taxes in dollars from the Japanese operations is closest to:

Definitions:

Manual Dexterity

The skillful use of the hands and fingers to perform tasks with precision, often important in various professions and daily activities.

Gross Motor Development

The progression of physical abilities involving large muscle movements such as walking, jumping, and throwing, typically observed in early childhood development.

Motor Milestones

Specific physical skills or movements that most children achieve by a certain age, indicating developmental progress.

Novice Walker

A Novice Walker is an individual, typically a baby or toddler, who is in the early stages of learning to walk, mastering balance and coordination.

Q2: _ is the sensitivity of a firm's

Q11: What are internationally integrated capital markets?

Q19: What is the difference between an operating

Q24: Being long a futures contract is equivalent

Q29: What is the amount of Canadian taxes

Q39: Which of the following is true of

Q47: Instances in which exposure to the US

Q62: Hungry pigeons are presented with numerous tone-food

Q95: A firm issues three-month commercial paper with

Q99: A gold mining firm sells futures contracts