Use the information for the question(s) below.

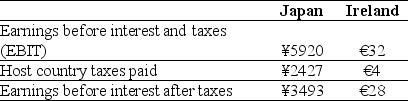

KT Enterprises,a Canadian import-export trading company,is considering its international tax situation.Currently KT's Canadian tax rate is 35%.KT has significant operations in both Japan and Ireland.In Japan,the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-After the Irish taxes are paid,the amount of the earnings before interest and after taxes in dollars from the Ireland operations is closest to:

Definitions:

Explicit Costs

Costs that involve direct monetary payment by a business to purchase or maintain resources.

Usury Law

Legal regulations that set maximum interest rates that can be charged on loans to protect consumers against excessively high rates.

Equilibrium Interest Rate

The interest rate at which the demand for money in an economy equals the supply of money, maintaining a balance without excess surplus or shortage.

Market Equilibrium

The state in which market supply equals market demand, leading to price stability.

Q6: Based upon the average EV/EBITDA ratio of

Q21: A firm forecasts its free cash flow

Q26: Tata Motors,a car manufacturer,has decided to enter

Q32: The spot exchange rate for the British

Q39: Two firms can use vertical integration to

Q62: Hungry pigeons are presented with numerous tone-food

Q66: A Brazilian firm owes you $2,000,000,payable in

Q83: Habituation is to sensitization as<br>A)motor is to

Q109: A firm's credit terms specify "1/10 net

Q110: A firm expects growth next year to