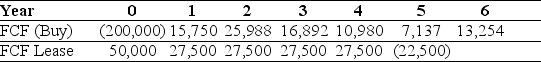

Use the table for the question(s) below.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

-If your firm's borrowing cost is 6% and the tax rate is 35%,what is the NPV of buying and leasing?

Definitions:

Enhance Rapport

The process of building a positive relationship or improving communication between individuals, often used in therapeutic, clinical, or professional contexts.

Language Barrier

A lack of mutual understanding due to differences in languages or dialects between communicators.

Health Interview

A conversation between a healthcare provider and a patient that aims to collect comprehensive information about the patient's medical history, current health status, and lifestyle.

Nurse's Question

Inquiries made by a nurse to gather information about a patient's health status or symptoms.

Q3: Which of the following is an example

Q5: Which of the following is an example

Q10: Your firm purchases goods from its supplier

Q16: The one-year forward exchange rate for the

Q17: How can a conservative financing policy reduce

Q29: Why would one use an animal model

Q31: Consider two firms,Bob Company and Cat Enterprises,both

Q42: When a firm can pass on its

Q50: The Holiday Corporation had sales of $450

Q97: A provision in an insurance policy in