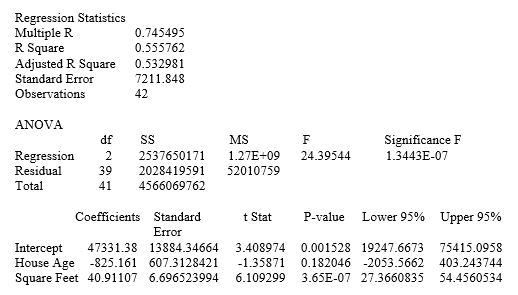

Scenario 2: Below is a multiple regression in which the dependent variable is market value of houses and the independent variables are the age of the house and square footage of the house. The regression was estimated for 42 houses.

-Refer to Scenario 2.Based on the 95 percent confidence intervals for each of the partial regression coefficients,which independent variable is statistically different from zero and why?

Definitions:

Interest Rate

The percentage of a sum of money charged for its use, typically expressed as an annual percentage.

Total Investment

The total amount of money invested in assets, projects, or securities by individuals, companies, or governments.

Expected Rate

The Expected Rate often refers to the anticipated return or yield on an investment, savings, or any financial product over a specified period.

Market Rate

The prevailing price in the market for goods or services, influenced by supply and demand dynamics.

Q3: Assume that with existing tax and spending

Q20: If an industry is characterized by economies

Q24: Assume the firms in a perfectly competitive

Q31: The soft drink industry can best be

Q34: The key characteristic of an oligopolistic market

Q46: At a price of $5,consumers buy 200

Q58: If a firm experiences constant returns to

Q72: The technique that estimates long-run costs and

Q81: Predatory pricing is used primarily to:<br>A)discourage new

Q108: As we move down a linear demand