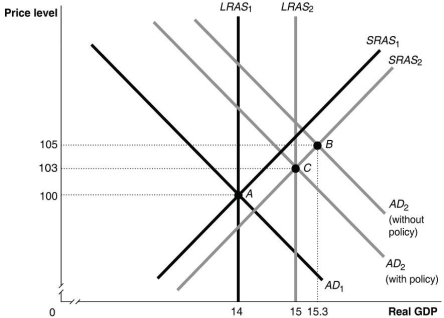

Refer to Figure 12.5 for the following question.

Figure 12.5

-Refer to Figure 12.5. In this figure, suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B. Which of the following policies could the Reserve Bank of Australia use to move the economy to point C?

Definitions:

Net Capital Outflow

The net balance resulting from domestic residents buying foreign assets and foreigners buying domestic assets.

Real Interest Rate

The interest rate adjusted for inflation, indicating the real profit of an investment or the real cost of borrowing.

Government Budget Deficit

A financial situation that occurs when a government's expenditures exceed its revenues in a given fiscal period.

National Saving

National saving, also known as domestic saving, is the sum of private and public saving, representing the part of national income that is not consumed or spent by the government.

Q15: Suppose that Australia's price level is 200,

Q21: Explain how The Economist's (2016)'Big Mac Index'

Q35: According to purchasing power parity, currencies will

Q48: Along a short-run aggregate supply curve, a

Q68: What is the difference between 'demand-pull inflation'

Q72: Suppose that the economy is at point

Q102: If the central bank uses interest rate

Q114: Suppose that your bank's reserve ratio is

Q129: What is the result of an increase

Q140: If interest rates in Australia rise, ceteris