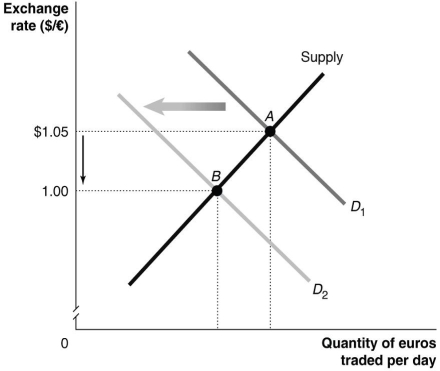

Refer to Figure 15.2 for the following questions.

Figure 15.2

-Which of the following would cause the change depicted in Figure 15.2? Note that the figure depicts the quantity of euros traded.

Definitions:

Deferred Tax Asset

An accounting item on the balance sheet that represents a future tax payment obligation to the IRS, which results in reduced taxes payable in future periods.

Income Tax Liability

The amount of tax that an individual or corporation owes to the government based on their income earnings for the fiscal year.

Deferred Tax Liability

A tax obligation that a company owes but is not yet required to pay, resulting from temporary differences between the company's accounting and tax treatment of assets and liabilities.

Revenue

The total income generated by a company from its normal business operations.

Q18: Rising prices erode the value of money

Q24: Refer to Figure 12.3. In this figure,

Q52: Falling interest rates can:<br>A)increase a firm's share

Q53: What is 'fiscal policy' and who is

Q81: As Australia's net foreign investment is negative,

Q99: If the Reserve Bank of Australia sells

Q123: 'Expansionary fiscal policy' is used by the

Q138: The Bretton Woods System was a system

Q143: Consider the hypothetical information in the following

Q144: Tax increases on business income slow down