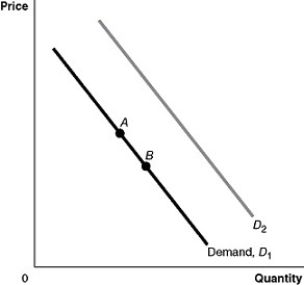

Figure 3-1

-Refer to Figure 3-1.A decrease in taste or preference would be represented by a movement from

Definitions:

Exercise Price

The price at which an option holder can buy (call) or sell (put) the underlying asset.

Zero Coupon Bond

A type of bond that does not pay periodic interest payments and is instead issued at a discount to its face value, which is the amount paid to the holder at maturity.

Risk-Free Rate

The expected return on an investment that carries no risk, commonly exemplified by the interest rate on government bonds.

Call Option

An option contract that grants the holder the right to buy an underlying asset at a predetermined price before the option expires, without the obligation to do so.

Q24: Auctions in recent years have resulted in

Q50: Refer to Figure 4-8.The price buyers pay

Q58: In a modern mixed economy, who decides

Q89: Refer to Table 4-4.Suppose that the quantity

Q127: A demand curve shows<br>A)the willingness of consumers

Q157: Refer to Figure 4-5.Suppose that instead of

Q172: Which of the following is a microeconomic

Q213: When you purchase a new pair of

Q228: Define productive efficiency.Does productive efficiency imply allocative

Q240: On a two-dimensional graph, _ illustrates the