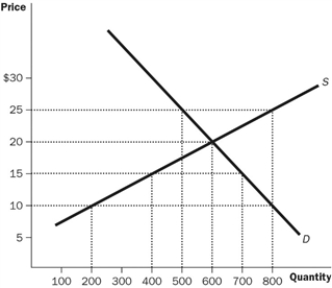

Figure 4-4

-Refer to the Figure 4-4. If the price is $10, what would happen?

Definitions:

Yield Curve

A graphical representation showing the relationship between the interest rates on debts of different maturities, typically of government bonds, highlighting investors' expectations for future interest rates and economic conditions.

Liquidity Premium

An additional return that investors demand for holding securities that are not easily convertible into cash without a significant loss in value.

Holding-Period Return

The total return received from holding an asset or portfolio of assets over a specified time period, often measured as a percentage.

Market Interest Rates

The prevailing rate at which borrowers are willing to borrow and lenders are willing to lend in the financial market.

Q37: Refer to Figure 3-6.If Barney and Betty

Q46: Suppose that the number of buyers in

Q56: Wheat is the main input in the

Q103: Market demand is given as Q<sub>D </sub>=

Q123: What does a relatively steep demand curve

Q152: Refer to Figure 2-9.What is this type

Q194: Trade allows a country to consume outside

Q205: Market demand is given as Q<sub>D </sub>=

Q216: You have decided to purchase a new

Q230: What impact does a person's expectations about