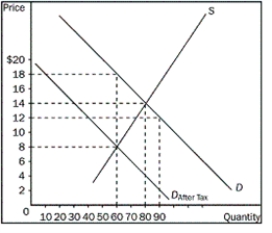

Figure 6-9

-Refer to Figure 6-9.What is the share of the tax burden per unit that buyers would pay

Definitions:

Proportional

Relating to or denoting a relationship where a change in one quantity results in a corresponding proportional change in another quantity.

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Income-Tax Filers

Individuals or entities that submit a report of their income to a governmental body to assess tax liabilities.

Efficiency Losses

The reduction in economic welfare resulting from distortions in resource allocation or market behavior.

Q1: When quantity demanded responds substantially to changes

Q17: Suppose that a decrease in the price

Q37: What is the difference between slope and

Q76: Suppose that the Canadian Medical Association announces

Q99: Which equation calculates total surplus<br>A)Total surplus =

Q100: What does consumer surplus measure<br>A)the amount of

Q101: Who is the marginal seller<br>A)the seller who

Q138: A market is a group of buyers

Q162: What is one reason that government taxes

Q243: Market demand is given as Q<sub>D </sub>=