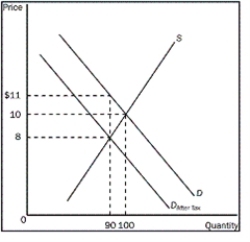

Using the graph shown below,answer the following questions.

a.What was the equilibrium price in this market before the tax

b.What is the amount of the tax

c.How much of the tax will the buyers pay

d.How much of the tax will the sellers pay

e.How much will the buyer pay for the product after the tax is imposed

f.How much will the seller receive after the tax is imposed

g.As a result of the tax,what has happened to the level of market activity

Definitions:

Treasury Bond

A long-term, interest-bearing security issued by the government, with a maturity period typically longer than ten years.

Xerox

A corporation known primarily for its photocopying products and technology, though it has diversified into digital printing and document solutions.

Exxon

A multinational oil and gas corporation headquartered in the United States, known for its significant role in the global energy sector.

Coupon Bond

A type of bond that pays the holder a regular interest rate (or coupon) in addition to the principal amount at maturity.

Q50: According to many economists,what do government restrictions

Q54: Refer to Table 7-3.If the price is

Q86: Refer to Figure 9-4.What is consumer surplus

Q93: A binding price ceiling is imposed on

Q147: Which of the following types of goods

Q161: When will the supply of a good

Q186: Goods with close substitutes tend to have

Q188: Supply is said to be inelastic if

Q219: What does the price elasticity of supply

Q240: A shortage will occur at any price