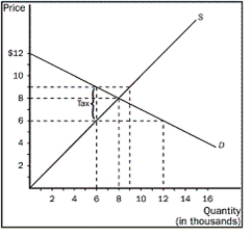

Using the graph shown below,answer the following questions.

a.What was the equilibrium price and quantity in this market before the tax

b.What is the amount of the tax

c.How much of the tax will the buyers pay

d.How much of the tax will the sellers pay

e.How much will the buyer pay for the product after the tax is imposed

f.How much will the seller receive after the tax is imposed

g.As a result of the tax,what has happened to the level of market activity

Definitions:

Narrowcasting

The dissemination of information to a fairly small, select audience that is defined by its shared values, preferences, or demographic attributes.

Major Television Networks

Large national or international broadcasting organizations that distribute television content across a wide geographic area.

Product Placement

An advertising technique in which a company promotes its products through appearances in movies or on television shows or other media.

Advertisement

A marketing communication intended to inform, persuade, or remind consumers about a product or service, typically paid for and disseminated through various media channels.

Q13: What is market failure<br>A)the inability of buyers

Q16: Who pays the majority of a tax

Q42: In general,on which side of the market

Q51: Refer to Figure 9-4.What is total surplus

Q74: Market demand is given as Q<sub>D </sub>=

Q80: Refer to Figure 5-8.Between point A and

Q99: Which equation calculates total surplus<br>A)Total surplus =

Q118: Refer to Figure 6-8.What is the equilibrium

Q163: What will a tax placed on the

Q204: Answer each of the following questions on