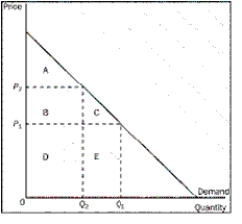

Figure 7-1

-Refer to Figure 7-1.When the price rises from P₁ to P₂,what happens to consumer surplus

Definitions:

Face Value

The nominal or dollar value printed on a financial instrument such as a bond or stock certificate, representing the value the issuer promises to pay at maturity.

Investment Yield

The earnings generated and realized on an investment over a particular period of time, expressed as a percentage of the investment's cost.

Maturity Date

The final payment date of a loan or other financial instrument, at which point the principal (and all remaining interest) is due to be paid.

Compound Annual

The rate of return that would be required for an investment to grow from its beginning balance to its ending one, assuming the profits were reinvested at the end of each period of the investment's lifespan.

Q23: When a country allows trade and becomes

Q29: What is cost a measure of<br>A)the seller's

Q70: What is consumer surplus<br>A)a buyer's willingness to

Q117: Using the equations shown below,answer the following

Q120: The Laffer curve is the curve showing

Q171: Suppose the government places a tax on

Q177: When a country allows trade and becomes

Q178: Economists use the term tax incidence to

Q186: Refer to Figure 8-4.Which area represents producer

Q202: What would result from government attempts to