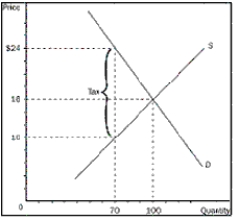

Figure 8-3

-Refer to Figure 8-3.What is the price that will be paid after the tax

Definitions:

Payroll Taxes

Financial impositions on either employees or the companies that employ them, often gauged as a portion of the wages that employees receive.

Federal Tax Revenue

Federal Tax Revenue is the income collected by the government through various forms of taxes, including income tax, corporate tax, and other taxes, funding government operations and services.

Taxpayers

Taxpayers are individuals or entities that are obligated to make payments to governmental authorities, these payments are typically based on the earnings or property owned by the taxpayer.

Great Depression

A severe worldwide economic downturn that took place during the 1930s, leading to high unemployment, deflation, and significant financial distress globally.

Q27: If a tax is imposed on the

Q32: Use the following graph shown to fill

Q37: What is an externality<br>A)the impact of society's

Q62: When a country allows trade and becomes

Q94: Market demand is given as Q<sub>D </sub>=

Q123: Refer to Figure 8-6.What would consumer surplus

Q148: What are the benefits of using corrective

Q172: When a country takes a unilateral approach

Q186: What does a demand curve measure<br>A)a buyer's

Q211: When markets fail,what can public policy do<br>A)nothing