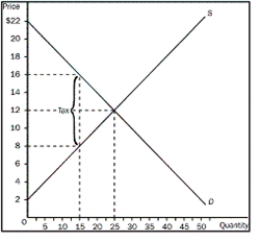

Figure 8-6

-Refer to Figure 8-6.What would the total surplus with the tax be

Definitions:

Distribution Of Income

The way in which total income is shared among different individuals or groups in an economy.

Market System

Here, economic decisions about where to invest, what and how much to produce, and how to distribute goods are made based on supply and demand curves, with pricing for these goods and services being freely adjusted in a market-based pricing structure.

Economic Questions

Fundamental queries regarding what to produce, how to produce, and for whom to produce, which economies must address.

Goods And Services

The products and activities that satisfy human wants, available for purchase in the marketplace, including both tangible items and intangible performances.

Q7: What happens when a tax is levied

Q27: If a tax is imposed on the

Q48: What should be used to analyze economic

Q55: What is the belief with industrial policy<br>A)Industries

Q80: Because taxes distort incentives,they cause markets to

Q80: Import tariffs cause the quantity of imports

Q82: Why are too few resources generally devoted

Q91: Figure 9-3 represents the domestic hoverboard market

Q197: Refer to Figure 8-5.If the tax is

Q205: When the social cost curve is above