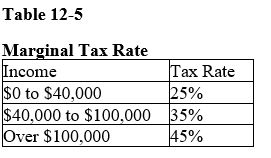

Table 12-5

-Refer to Table 12-5.What is the approximate average tax rate for a person who makes $130,000

Definitions:

EBIT-EPS Analysis

A tool used in financial analysis to determine the impact of leverage on a company's earnings per share (EPS) by holding earnings before interest and taxes (EBIT) constant.

Leverage Levels

The degree to which a business or investor is utilizing borrowed money.

EPS

Earnings Per Share, a company's profit divided by its number of outstanding shares of common stock, indicating how much money each share earns.

EBIT

The measure known as Earnings Before Interest and Taxes determines a company's profit levels by excluding interest and tax-related expenses.

Q35: The average total-cost curve is unaffected by

Q54: Tax evasion is legal,but tax avoidance is

Q68: Internalizing a negative externality will cause the

Q100: The most important taxes for the federal

Q104: If a small country imposes a tariff

Q107: Refer to Figure 13-5.At levels of output

Q110: Refer to Figure 13-4.Which of the curves

Q113: What are two types of private solutions

Q185: Please complete the following table and show

Q214: Which production decision is a profit-maximizing firm