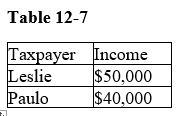

Table 12-7

-Refer to Table 12-7.If the government imposes a $3000 lump-sum tax,what would be the marginal tax rate for Paulo

Definitions:

Unrecognized Prior Service Cost

Refers to costs from past services not yet recognized in financial statements for pension plans.

Accrued/Prepaid Pension Cost

Expenses related to pension plans that have been incurred but not yet paid, or paid in advance of the period to which they apply.

Accumulated Other Comprehensive Income

A component of shareholders' equity that includes all changes in equity from non-owner sources, excluding net income.

Projected Benefit Obligation

A measure of the present value of future pension benefits owed to employees, calculated based on their expected future salary increases.

Q6: When the marginal tax rate exceeds the

Q8: When might transaction costs arise<br>A)They can arise

Q36: What costs do firms that shut down

Q48: The government often intervenes when private markets

Q91: Refer to Scenario 13-2.For the first year

Q139: Refer to Figure 14-3.What line segment best

Q177: When existing firms in a competitive market

Q182: Who pays primarily for public schools,which educate

Q203: Refer to Figure 10-6.Which curve best represents

Q261: The Wheeler Wheat Farm has a long-term