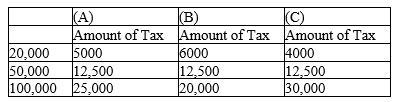

Using information from the table below,calculate the average tax rate and marginal tax rate as income changes from 20,000 to 50,000 and from 50,000 to 100,000 for tax system A,B,and C.Describe the relationship between average tax rates and marginal tax rates for each of these three systems.Which rate is more relevant for judging the vertical equity of a tax system

Definitions:

Financial Meltdown

A severe and sudden downturn in financial markets, leading to a loss of asset values and confidence in the financial system.

Economic Model

A simplified representation of economic processes, used to analyze and predict economic behaviors and outcomes.

Economists

Professionals specializing in the study of economies, analyzing the production, distribution, and consumption of goods and services.

Simulate

To imitate the operation of a real-world process or system over time for purposes of experiment or training.

Q44: What does diminishing marginal product suggest<br>A)Additional units

Q49: What is one reason that deadweight losses

Q66: Total cost can be divided into two

Q111: How is total profit for a firm

Q122: When marginal cost is rising,what must happen

Q133: What is the ranking of these taxes

Q180: Refer to Figure 13-4.When is this particular

Q191: A technology spillover is a type of

Q219: Refer to Figure 14-9.If the market starts

Q258: When a perfectly competitive firm makes a