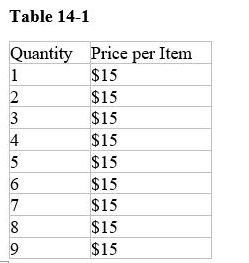

Table 14-1

-Refer to Table 14-1.Over what range of output is average revenue equal to price

Definitions:

Taxable Income

The portion of an individual's or entity's income that is subject to taxation after allowances, exemptions, and deductions.

Tax Liability

The total amount of taxes owed by an individual, corporation, or other entity to tax authorities.

Taxable Income

The amount of an individual's or entity's income used to determine how much tax is owed to the government.

Permitted Deductions

Allowable subtractions from gross income that reduce taxable income, as defined by tax laws.

Q52: When a competitive market experiences an increase

Q95: Refer to Table 14-1.What is the marginal

Q103: Tim earns income of $60,000 per year

Q115: The Arkell Spring Grounds is a high

Q147: Refer to Scenario 12-1.How much total consumer

Q168: What does an efficient tax system do<br>A)It

Q172: How does the average-fixed-cost curve behave<br>A)It always

Q197: Which of the following does NOT calculate

Q213: In a perfectly competitive market,when will the

Q224: Refer to Figure 15-3.What would profit be