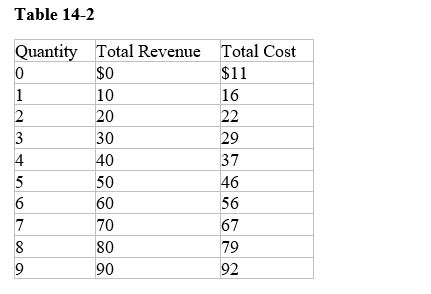

Table 14-2

-Refer to Table 14-2.At a production level of 5 units,what do we know about marginal revenue

Definitions:

Trade

The action of buying and selling goods and services among parties, which can occur within a country (domestic) or between countries (international).

Tariff

A tax imposed on imported goods to increase their price, intended to protect domestic industries.

Imported Good

A product or service brought into one country from another for the purpose of sale.

Tax

A compulsory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization to fund government spending and various public expenditures.

Q42: Refer to Scenario 12-1.If a tax of

Q42: When a firm in a competitive market

Q72: Which statement best defines a regressive tax

Q76: If a monopoly sells a quantity of

Q87: When will a monopolist choose to increase

Q99: When one person enjoys the benefit of

Q148: What is a common theme among examples

Q179: Refer to Scenario 15-2.What is the firm's

Q198: Accountants often ignore implicit costs.

Q212: For any given price,a firm in a