Table 15-1

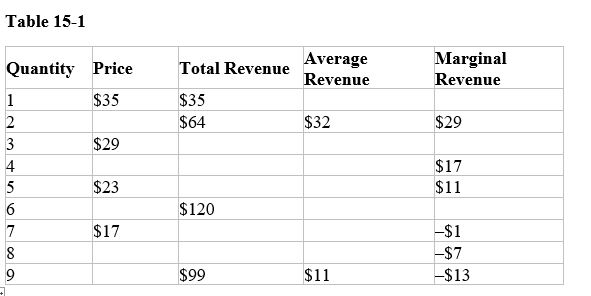

-Refer to Table 15-1.Assume this monopolist's marginal cost is constant at $11.What quantity (Q) of output will it produce and what price (P) will it charge

Definitions:

Tax Deductible

Expenses that can be subtracted from gross income to reduce the amount of income subject to tax.

Deferred Tax Asset

A tax benefit arising from temporary differences between the book value and tax basis of assets and liabilities, which will result in deductible amounts in future periods.

Deferred Tax Liability

A tax obligation that arises from temporary differences between the book value and tax value of assets and liabilities, to be paid in the future.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated as depreciation expense over the asset's useful life.

Q13: Which of the following is an example

Q15: Suppose you bought a ticket to a

Q71: Refer to Figure 15-6.What is the loss

Q98: Advocates for advertising argue that the efficiency

Q99: When a profit-maximizing firm in a competitive

Q162: In a competitive market,a firm's supply curve

Q178: A firm is selling its product in

Q204: When a firm operates under conditions of

Q222: How is a monopolist's profit-maximizing quantity of

Q233: In theory,which outcome occurs with perfect price