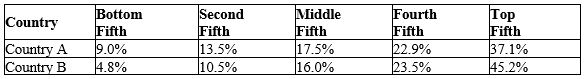

The table below reflects the levels of total utility received from income for each of four members of a society.

a.Assume that the society has the following income distribution:

Peter: $3

Paul: $7

Mary: $5

Jane: $3

Is it possible for the government to increase total aggregate utility by redistributing income among members of society

Explain your answer.

b.Assume that the government has $19 to allocate among the four members of society.(Assume that no one has any income to start with.) If the government is interested in distributing income in a way that maximizes aggregate total utility, how should it distribute the $19 of income

c.Does the table above describe a situation characterized by diminishing marginal utility? Explain your answer.

Definitions:

Depreciation

An accounting method used to allocate the cost of a tangible asset over its useful life.

Net Capital Spending

The total expenditure on physical assets less any asset sales, reflecting how much a company is investing in its physical assets.

CCA Rate

The annual depreciation rate used under the Canadian tax system to calculate depreciation expense for tax purposes on a depreciable asset.

CCA

An acronym that can stand for Capital Cost Allowance, which is a tax deduction for depreciable property in Canada.

Q20: What is most likely if a profit-maximizing

Q43: In the work-leisure model,the income effect of

Q57: A Giffen good is one for which

Q59: Delilah knows that she will ultimately face

Q68: In 2014,the dangerous Ebola virus entered Canada

Q72: Refer to Table 22-2.What is a possible

Q78: The free movement of capital around the

Q87: For normal goods like cola and pizza,what

Q97: Refer to Scenario 18-3.In what way did

Q140: Assume there are nine voters in a