Multiple Choice

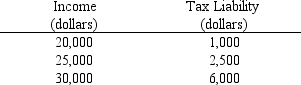

Use the table below to choose the correct answer.

The marginal tax rate on income in the $25,000 to $30,000 range is

Definitions:

Related Questions

Q43: As a general rule, technological progress<br>A)shifts the

Q46: A good is considered nonexcludable if<br>A)many individuals

Q52: Which of the following generalizations about the

Q53: Refer to Figure 2-9. The opportunity cost

Q78: The more elastic the supply of a

Q86: Special-interest legislation is characterized by<br>A)concentrated costs and

Q115: When a shortage of a good is

Q126: How will a reduction in the price

Q180: Refer to Table 2-2. According to the

Q187: A tax imposed on the sellers of