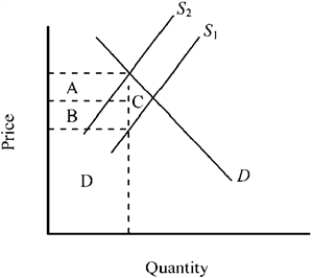

Use the figure below to answer the following question(s) .

Figure 4-10

-Refer to Figure 4-11. On the Laffer curve shown, tax revenue could be increased by

Definitions:

Gross Margin

The difference between sales revenue and cost of goods sold, expressed as a percentage of sales revenue, indicating the financial health and profitability of a business.

Absorption Costing

An approach to costing that encompasses all costs associated with manufacturing, including direct materials, direct labor, as well as variable and fixed manufacturing overheads, in the product cost.

Absorption Costing

A strategy in accounting practice that aggregates all manufacturing expenses, from direct materials and labor to variable and fixed overheads, into the determination of a product's cost.

Break-Even Sales

The amount of revenue required to cover both the variable and fixed costs of a business, indicating no profit and no loss.

Q27: How does the text define economic efficiency?

Q37: Studies indicate the demand for cigarettes is

Q41: If a $2 tax per bottle of

Q49: If the price of a good is

Q52: Noah drinks Dr. Pepper. He can buy

Q101: From the viewpoint of economic efficiency, when

Q124: An increase in the price of plastic

Q133: The revenue generated by the tax illustrated

Q146: Suppose the Pleasant Corporation cuts the price

Q199: The imposition of price ceilings on a