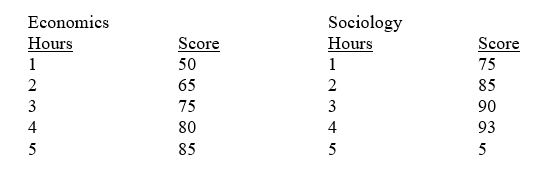

You have five hours left to study for two exams tomorrow.The relationship between hours of study and test scores is as follows:

Use the rule for determining optimal purchases to allocate your time, where each point is one "util" of utility.

Definitions:

Tax Imposed

A financial charge or levy placed by a government on an individual or an entity to fund public expenditures.

Buyer Pays

A pricing term indicating that the purchaser is responsible for the cost of goods, shipping, and any additional expenses associated with the purchase.

Tax Incidence

Describes how the burden of a tax is distributed between buyers and sellers, depending on the relative elasticities of supply and demand.

Levied On

Imposed or applied, typically in the context of taxes or duties on goods, services, or income.

Q16: The short run is the time period

Q30: Total expenditure equals price times elasticity.

Q86: The laws of supply and demand force

Q91: Given a typical demand curve and a

Q142: How do you calculate consumer's surplus? What

Q193: In Figure 7-2 at an output of

Q206: Assume the market consists of three consumers

Q221: A common misconception about supply is that<br>A)supply

Q236: The demand curve for a typical good

Q293: When price is above the equilibrium level,