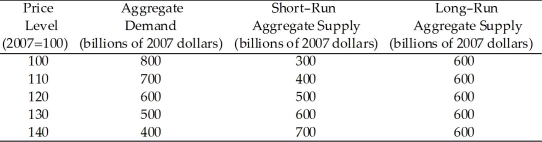

Use the table below to answer the following questions.

Table 26.3.1

-Refer to Table 26.3.1. Consider the economy represented in the table. The economy is in

Definitions:

Short-term Capital Gains

Profits from the sale of an asset held for a year or less, typically taxed at higher rates than long-term capital gains.

Section 1202

A provision in the U.S. tax code offering exclusion on gains from the sale or exchange of qualified small business stock held for more than 5 years.

Preferential Rates

Tax rates lower than the standard rates, often applied to long-term capital gains and qualified dividends.

Gross Assets

The total sum of an individual's or entity's assets before any liabilities or deductions are taken into account.

Q1: Real business cycle theorists believe that the

Q42: Expansionary fiscal policy<br>A)increases aggregate demand.<br>B)decreases aggregate demand.<br>C)increases

Q70: The marginal propensity to consume is calculated

Q77: Refer to Figure 27.1.1. The marginal propensity

Q91: In Table 3.4.1, the equilibrium quantity is<br>A)200

Q107: Between 1999 and 2008, Canada was<br>A)a net

Q115: Canada's exports to the European Union boom.

Q124: Households will choose to save more if<br>A)expected

Q129: The supply of loanable funds curve<br>A)has a

Q147: The slope of the consumption function is<br>A)less