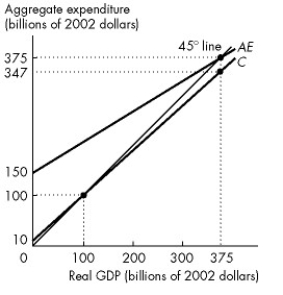

Use the figure below to answer the following questions.

Figure 27.2.3

There are no taxes in this economy.

-In Figure 27.2.3, autonomous expenditure is

Definitions:

Income Inequality

The unequal distribution of income among individuals or households within a population.

Goods And Services

The physical items (goods) and activities or benefits (services) that fulfill consumer needs and wants.

Progressive Tax

At the individual level, a tax whose average tax rate increases as the taxpayer’s income increases. At the national level, a tax for which the average tax rate (= tax revenue/GDP) rises with GDP.

Average Tax Rate

Total tax paid divided by total taxable income or some other base (such as total income) against which to compare the amount of tax paid. Expressed as a percentage.

Q7: The short-run aggregate supply curve indicates<br>A)the relationship

Q22: If a household's disposable income increases from

Q25: Consider an economy starting from a position

Q30: The long-run aggregate supply curve is<br>A)vertical.<br>B)negatively sloped.<br>C)positively

Q36: Refer to Figure 27.2.1. Equilibrium real GDP<br>A)is

Q62: Refer to Figure 28.2.6. Starting at point

Q67: Which one of the following would lead

Q105: Consider Fact 28.2.1. The news clip is

Q106: An increase in the price level due

Q187: Refer to Figure 3.5.2, which represents the