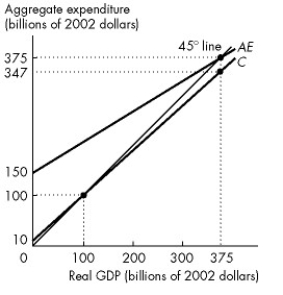

Use the figure below to answer the following questions.

Figure 27.2.3

There are no taxes in this economy.

-In Figure 27.2.3, the marginal propensity to import is

Definitions:

Incidence Of Tax

The analysis of who bears the ultimate burden of a tax, whether it be consumers, producers, or others.

Excise Tax

A tax levied on the sale or use of specific products or transactions, often included in the price of goods like gasoline, alcohol, and tobacco.

Supply Shift

A change in the availability of a product or service, often influenced by factors such as production costs and technological advances, shifting the supply curve.

Excise Tax

A type of tax imposed on specific goods, services, or activities, often included in the price of products like gasoline, alcohol, and tobacco.

Q15: According to real business cycle theory, if

Q44: In Figure 25.3.1, suppose the demand for

Q44: You observe that unplanned inventories are increasing.

Q48: Suppose we observe a rise in the

Q60: An increase in income<br>A)increases the demand for

Q60: Money is<br>A)equivalent to barter.<br>B)currency plus credit cards

Q61: Foreign currency is<br>A)the market for foreign exchange.<br>B)the

Q93: The Bank of Canada is the lender

Q114: Consider Table 23.3.6. If the Ricardo-Barro effect

Q124: If the current account is in surplus