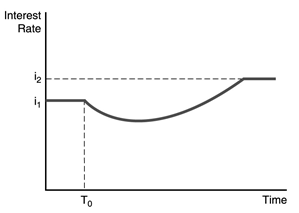

Use the following figure to answer the question :

-Interest rates increased continuously during the 1970s. The most likely explanation is

Definitions:

Strike Price

The price at which the holder of an options contract can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Stock Price

The value at which a specific stock is traded on the market, reflecting the current market valuation of a company.

Intrinsic Value

The inherent worth of an asset, independent of its market price, based on its ability to generate cash flow or other fundamental attributes.

Exercise Price

The price at which the holder of an option contract can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Q20: Everything else held constant,an increase in marginal

Q25: In the market for money,when the Fed

Q25: Increasing transactions costs of selling an asset

Q38: Both the CAPM and APT suggest that

Q39: In the Keynesian liquidity preference framework,a rise

Q52: Collateralized debt is also know as<br>A)unsecured debt.<br>B)secured

Q72: If a bank has _ rate-sensitive assets

Q78: Everything else held constant,the interest rate on

Q83: Everything else held constant,when prices in the

Q85: Of the following methods that banks might