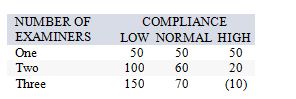

The local operations manager for the Internal Revenue Service must decide whether to hire one, two, or three temporary tax examiners for the upcoming tax season. She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Congress, as follows:  If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

Definitions:

Indirect Manufacturing Costs

These are costs that cannot be directly traced to specific units produced, such as maintenance and cleaning, and are part of the manufacturing overhead.

Incremental Manufacturing Cost

Refers to the additional cost incurred for producing one more unit of a product.

Contribution Margin

The amount remaining from sales revenue after all variable expenses have been deducted, indicating how much revenue is available to cover fixed costs and generate profit.

Direct Manufacturing Cost

The sum of all the costs directly associated with the production of a good, including raw materials and direct labor.

Q7: According to learning curve theory, every doubling

Q20: Capacity planning requires an analysis of needs:

Q32: The dean of a school of

Q34: Budgeting, analysis of investment proposals, and provision

Q42: Which of the following helps improve supply

Q46: The advertising manager for Roadside Restaurants, Inc.,

Q64: Taking a systems viewpoint with regard to

Q90: Which of the following concerns is not

Q113: The naive forecast is limited in its

Q132: As a general rule, continuous processing systems