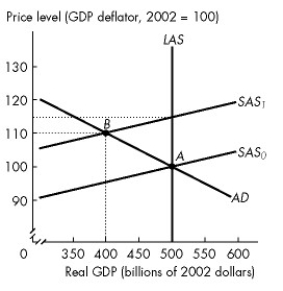

Use the figure below to answer the following questions.

Figure 28.2.2

-Refer to Figure 28.2.2. If SAS shifts from SAS₀ to SAS₁, then

Definitions:

Return on Assets

A financial ratio indicating how profitable a company is relative to its total assets.

Weighted Average Cost of Capital

An average representing the expected return on all of a company's securities, weighted according to the proportion each contributes to the total capital structure.

Systematic Risk

The risk inherent to the entire market or market segment, also known as market risk.

Levered Firms

Companies that use debt in their capital structure alongside equity.

Q1: Consider Fact 28.4.1. Choose the statement that

Q34: Everything else remaining the same, which one

Q59: Expansionary fiscal policy<br>A)increases aggregate demand.<br>B)decreases aggregate demand.<br>C)increases

Q61: Suppose that the country of Pacifica sold

Q72: Which of the following sayings best describes

Q80: The exchange rate is volatile because<br>A)government policy

Q91: Which of the following will lower the

Q97: Refer to Fact 1.3.1.The cost of regenerating

Q118: The fundamental force that drives international trade

Q128: Classical macroeconomists recommend<br>A)policies that actively offset changes