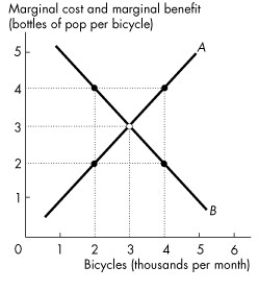

Use the figure below to answer the following questions.

Figure 2.2.1

-In Figure 2.2.1, when 2,000 bicycles are produced each month,

Definitions:

Partnership

A legal arrangement in which two or more people share ownership of a business, including its profits, losses, and responsibilities.

Tax Preference Items

Items or income types that receive preferential tax treatment, often reducing the tax liability for an individual or entity.

AMT Calculation

The process of determining the amount of Alternative Minimum Tax an individual or corporation owes by adjusting certain tax preference items and deductions.

AMTI

Stands for Alternative Minimum Taxable Income, which is calculated by adding certain tax preference items back into adjusted gross income.

Q15: In Figure 31.1.2, with international trade _

Q15: Refer to Table 3.5.2.Professor Hyper publishes a

Q31: Choose the statement that is incorrect.<br>A)Gains from

Q47: Consider the information in Table 4.2.1.Select the

Q112: A point inside a production possibilities frontier<br>A)indicates

Q123: Refer to Table 4.1.4.The table shows the

Q138: At price P₂ in Figure 3.4.1, which

Q153: A good economic model<br>A)does not include more

Q168: The fish stocks in the Atlantic fishing

Q168: Marginal benefit is the<br>A)total benefit from an