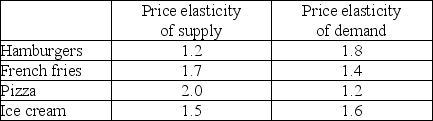

Use the table below to answer the following questions.

Table 6.3.2

-Refer to Table 6.3.2.You are in the business of producing and selling hamburgers,French fries,pizza,and ice cream.The mayor of your city plans to impose a sales tax on one of these products.Based on the elasticities in the table,on which of these goods would your customers least like to be taxed?

Definitions:

Direct Materials

Raw materials that are consumed in the production process and can be directly traced to the end product.

Total Variable Overhead Variance

The difference between the expected and actual costs of variable overheads in a manufacturing or production process.

Variable Overhead

Costs that vary with the level of production output, such as materials, utilities, and commissions, contrary to fixed overheads.

Total Direct Materials Cost Variance

The difference between the budgeted cost of direct materials and the actual cost incurred for the materials.

Q11: The difference in the market value of

Q11: The price of one good divided by

Q59: Refer to Figure 7.3.1.The tariff _ the

Q62: If a rent ceiling imposed by the

Q67: At the best affordable point, what is

Q92: Who benefits from imports?<br>A)domestic consumers<br>B)domestic producers<br>C)foreign consumers<br>D)domestic

Q102: In competitive equilibrium, which of the following

Q108: Import quotas and tariffs both<br>A)decrease deadweight loss.<br>B)cause

Q110: Reducing a tariff _ the domestic production

Q178: If demand decreases and supply increases, then