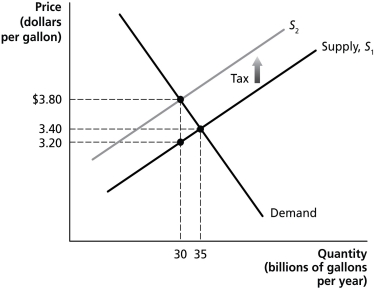

Figure 4-12

-Refer to Figure 4-12.The figure above represents demand and supply in the market for gasoline.Use the diagram to answer the following questions.

a.How much is the government tax on each gallon of gasoline?

b.What portion of the unit tax is paid by consumers?

c.What portion of the unit tax is paid by producers?

d.What is the quantity sold after the imposition of the tax?

e.What is the after-tax revenue per gallon received by producers?

f.What is the total tax revenue collected by the government?

g.What is the value of the excess burden of the tax?

h.Is this gasoline tax efficient?

Definitions:

Overhead Allocation

The process of distributing indirect costs to cost objects such as products, services, or departments.

Departmental Overhead Rate

The allocation of indirect costs to specific departments based on relevant activity bases, such as labor hours or machine hours, to more accurately assign costs.

Direct Labor Hours

The total hours worked by employees directly involved in manufacturing a product or providing a service.

Baking Department

A division within a business that specializes in the preparation and production of baked goods.

Q15: Refer to Figure 5-3.The efficient output level

Q19: Each person goes about her daily business

Q19: Economic efficiency is a market outcome in

Q59: When is demand perfectly elastic? When is

Q76: If a brewery wants to raise funds

Q144: Economists refer a to a market where

Q173: If a 5 percent increase in income

Q194: Refer to Table 4-6.The equations above describe

Q194: Use the following demand schedule for apples

Q275: If the price elasticity of demand for