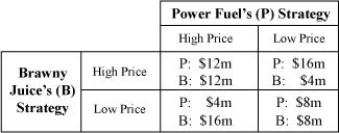

Table 14-8

Two rival oligopolists in the athletic supplements industry, the Power Fuel Company and the Brawny Juice Company, have to decide on their pricing strategy.Each can choose either a high price or a low price.Table 14-8 shows the payoff matrix with the profits that each firm can expect to earn depending on the pricing strategy it adopts.

-Refer to Table 14-8.If Brawny Juice selects a high price, what is Power Fuel's best strategy and what will Power Fuel earn as a result of this strategy?

Definitions:

Sales Growth

The increase in revenue generated from sales activities over a specific period, indicating the success of business strategies and market demand.

Product Time to Market

The duration it takes for a product to move from conception to being available for sale to consumers.

Return on Assets

A financial ratio that indicates the profitability of a company in relation to its total assets.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or the operating cycle, whichever is longer.

Q9: Refer to Table 13-4.Victoria's profit-maximizing output is

Q31: A profit-maximizing monopoly produces a lower output

Q110: Refer to Figure 15-2.To maximize profit, the

Q129: Refer to Figure 13-8.What is the profit-maximizing

Q152: Online companies gather personal information about the

Q167: Compared to a perfectly competitive firm, the

Q222: In an oligopoly, minimum efficient scale is

Q249: When a monopolistically competitive firm breaks even

Q251: A virtuous cycle occurs<br>A)when lobbyists petition members

Q275: In the short run, even if a