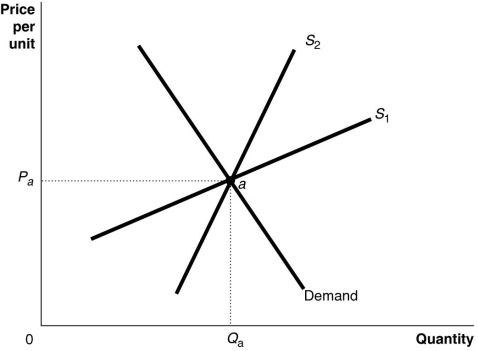

Figure 18-3

-Refer to Figure 18-3.The figure above shows a demand curve and two supply curves, one more elastic than the other.Use Figure 18-3 to answer the following questions.

a.Suppose the government imposes an excise tax of $1.00 on every unit sold.Use the graph to illustrate the impact of this tax.

b.If the government imposes an excise tax of $1.00 on every unit sold, will the consumer pay more of the tax if the supply curve is S₁ or S₂? Refer to the graphs in your answer.

c.If an excise tax of $1.00 on every unit sold is imposed, will the revenue collected by the government be greater if the supply curve is S₁ or S₂?

d.If the government imposes an excise tax of $1.00 on every unit sold, will the deadweight loss be greater if the supply curve is S₁ or S₂?

Definitions:

State Unemployment Taxes

Taxes paid by employers to fund the state's unemployment insurance program, providing financial assistance to workers who have lost their jobs.

Employee Payroll Deductions

Amounts withheld from an employee's salary for taxes, insurance, and other mandatory or voluntary contributions.

Federal Unemployment Taxes

Taxes paid by employers to the federal government to fund unemployment benefits and job service programs.

Insurance Pension Plans

Retirement plans that combine the benefits of insurance and savings, providing income after retirement through periodic premiums paid during a worker’s employment.

Q3: Explain how the courts decide between a

Q6: Which of the following is NOT a

Q9: A contract induced by fraud is void.

Q14: Laws made by parliaments are called statute

Q21: Which of the following is not an

Q30: Which of the following is NOT an

Q33: To recover special damages under the rule

Q50: Individuals may litigate which types of law

Q121: What is the shape of the labor

Q158: Serafina was earning $75 per hour and