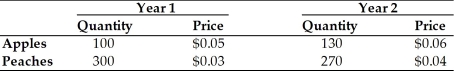

Table 2-2

-Refer to above Table 2-2.The chain-weighted GDP deflator for year 2 is

Definitions:

Taxable Income

The portion of an individual's or corporation's income that is subject to taxation by the government, after allowances, exemptions, and deductions.

Withholding Allowance

Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee's paycheck.

Taxable Income

The portion of an individual's or entity's income used to determine tax liability.

OASDI

Old-Age, Survivors, and Disability Insurance, a comprehensive federal benefits program that provides retirement, disability, and survivor benefits.

Q9: If a macroeconomic model consists of upward-sloping

Q30: The money supply is controlled by the<br>A)New

Q33: If the firm in Figure 17-4 above

Q46: Consider an initial IS-LM equilibrium with normally-sloped

Q56: If Y = $200 billion,c = 0.75,autonomous

Q69: From the last five recessions,the mildest two

Q76: Should autonomous consumption rise by one dollar,the

Q90: Replacing the simple Keynesian consumption function with

Q101: Following housing market collapse,U.S.personal saving rates have<br>A)increased.<br>B)decreased.<br>C)remained

Q112: If the interest rate were to fall,we