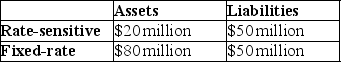

Use the following table to answer the question :

-Assuming that the average duration of its assets is five years,while the average duration of its liabilities is three years,then a 5 percentage point increase in interest rates will cause the net worth of First National to decline by ________ of the total original asset value.

Definitions:

Credit Card

A payment card issued to users as a method of payment allowing the cardholder to pay for goods and services based on the holder's promise to pay for them.

Sequential Game

A sequential game is a type of game theory model where players make decisions one after another, rather than simultaneously, allowing for the observation of previous choices.

Nash Equilibria

An idea in game theory in which no participant can benefit by altering their approach if all other participants maintain their strategies.

Dominant Strategy

A Dominant Strategy is a game theory concept where a player's best course of action remains unchanged regardless of what the opponent does.

Q3: In the figure above,the decrease in the

Q5: According to a survey conducted by the

Q19: Of the following financial intermediaries,which holds the

Q34: According to the textbook, the number one

Q43: If a bank has more rate-sensitive assets

Q52: An increase in the riskiness of corporate

Q62: If bad credit risks are the ones

Q72: Which of the following set of characteristics

Q94: When the growth rate of the money

Q96: Which of the following bank assets is