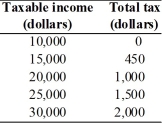

-The table above gives the taxable income and the amount of tax paid.

a.Is this income tax progressive,regressive,or proportional?

b.If the taxable income is $25,000,what is the average tax rate?

c.If taxable income increases from $25,000 to $30,000,what is the marginal tax rate?

Definitions:

Magnitudes

Refers to the sizes, amounts, or extents of different entities or variables in a context, often used in economic analysis.

R&D

R&D stands for Research and Development, a business or government activity that involves the investment of resources to create new products, processes, or services or to improve upon existing ones.

Technological Advance

The development and application of innovative technologies that enhance efficiency, productivity, or capabilities in processes, products, or services.

Production Possibilities

The various combinations of goods and services that a society can produce using its available resources and technology.

Q1: The above figure shows a labor market

Q38: The _ are hurt by importing a

Q60: If the average tax rate increases as

Q60: The above figure shows the U.S.market for

Q78: Marginal private cost<br>A)is always zero if there

Q137: Trade is often restricted because the<br>A)total gain

Q154: The above figure shows the U.S.market for

Q196: In order for pollution taxes to be

Q199: If Congress wanted to change the social

Q249: Based on the figure above, the deadweight