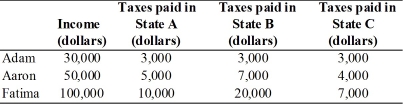

-Adam,Aaron,and Fatima earn,respectively,$30,000,$50,000 and $100,000 per year.The amount of state income taxes they pay on their income depends on which state they choose to live in.The table above shows how much they would pay in taxes in each state.

a.Is the tax in State A progressive,regressive or proportional?

b.Is the tax in State B progressive,regressive or proportional?

c.Is the tax in State C progressive,regressive or proportional?

Definitions:

Public Goods

Goods that are non-excludable and non-rivalrous, meaning they can be used by everyone and one person’s use does not diminish another's.

Corporate Income Tax

A tax levied on the net income (accounting profit) of corporations.

Product Prices

The amount of money required to purchase a product, influenced by cost of production, supply, demand, and market competition.

Minimum Standard

The lowest level of quality, performance, or subsistence considered acceptable by regulatory bodies or society.

Q89: The graph shows the market for textbooks.If

Q91: For a product with external benefits that

Q102: In the Village of Punjab, Sheryl owns

Q128: Based on the figure above, as a

Q166: Which of the following taxes best illustrate

Q186: After a tariff is imposed, consumers must

Q188: The methods that governments use to support

Q197: Which of the following is an example

Q217: The figure above shows the U.S.demand and

Q289: When logging in the Pacific Northwest destroys