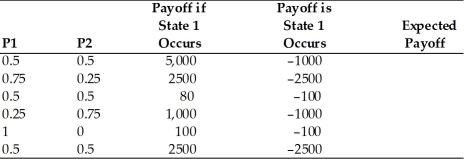

Calculate the expected payoff for the following cases with the formula: (P1) * (payoff if state 1) + (P2) * (payoff if state 2), where P1 and P2 are the probabilities of state 1 and 2, respectively.

Definitions:

Average Variable Cost

The total variable costs (costs that vary with production volume) divided by the quantity of output produced, representing the variable cost per unit.

Net Present Value (NPV)

The difference between the present value of cash inflows and the present value of cash outflows over a period of time. It's used to evaluate the profitability of an investment or project.

Capital Investment Funds

Financial resources that are used by a company to purchase physical assets like property, industrial buildings, or equipment.

Capital Rationing

The situation that exists if a firm has positive Net Present Value projects but cannot find the necessary financing.

Q25: A permanent increase in the domestic money

Q32: Describe the mechanism which would take place

Q33: Describe three types of gains from trades?<br>A)

Q48: What factor may cause a father to

Q64: What is the difference between an expenditure-changing

Q81: Explain why despite enormous natural resources, much

Q87: Federal Reserve Chairman Volcker's policy to fight

Q97: About _ of American children live in

Q105: Advocates of flexible exchange rates claim that

Q111: President Obama's family background is cited in