TABLE 16.1

Use the information to answer the following question(s) .

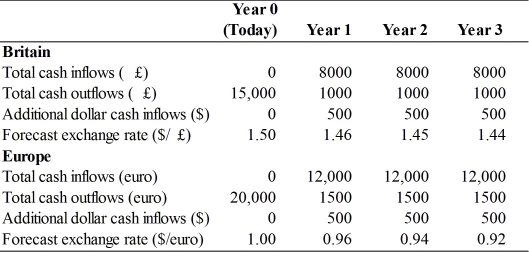

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

-Refer to Table 16.1.The NPV for the British investment is estimated at ________.

Definitions:

Proprietors' Income

The income earned by owners of unincorporated businesses, reflecting their production and sales efforts.

Rent

A periodic payment made by a tenant to a landlord in exchange for the use of land, a building, or another property.

Landlords

Individuals or entities that own real estate properties and rent them out to tenants, earning rental income in return.

Pierre-Joseph Proudhon

A French philosopher and politician, known for declaring "Property is theft!" and for his contributions to anarchist theory.

Q2: Which of the following would NOT be

Q12: Dividends are the most tax-efficient way to

Q14: Blocked funds are cash flows that<br>A)come in

Q28: Which of the following is the typical

Q38: What do theory and empirical evidence say

Q41: Generally speaking,currency risk decreases as time prior

Q43: The main technique to minimize translation exposure

Q50: A U.S.firm sells merchandise today to a

Q51: Generally speaking,a firm wants to receive cash

Q57: Firms might be tempted to order _