TABLE 16.1

Use the information to answer the following question(s) .

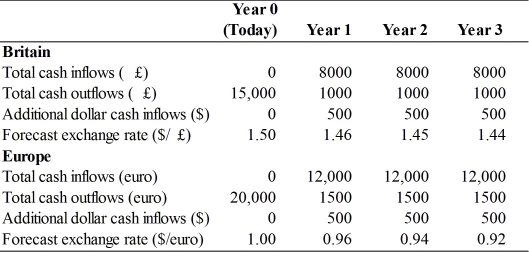

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

-Refer to Table 16.1.If the euro was forecast to remain constant at $1.00/euro throughout the investment period,how would the investment decision now be characterized?

Definitions:

Profit-Maximizing

A strategy or behavior aimed at increasing a firm's profits to the highest possible level given its production and cost constraints.

Pure Monopolist

A market scenario where a single seller completely dominates the market, facing no competition and controlling the price of the goods or services offered.

MR

Marginal Revenue, which refers to the additional income generated from selling one more unit of a good or service.

Variable Costs

Costs that change in proportion to the level of output produced.

Q7: In some respects,internationally diversified portfolios are different

Q8: The immediate impact on the balance of

Q13: Whether a person had access to and

Q13: What was the annualized forward premium on

Q27: If your company were to import and

Q30: What is a banker's acceptance? How are

Q34: Which of the following is the best

Q41: Generally speaking,currency risk decreases as time prior

Q44: Beginning in 1991 Argentina conducted its monetary

Q44: Swap and forward transactions account for an