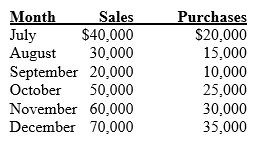

The following information pertains to Maxi Corporation:

∙ Cash is collected from customers in the following manner:

Month of sale 20%

Month following the sale 50%

Two months following sale 28%

Amount uncollectible 2%

∙ Thirty percent of purchases are paid for in cash in the month of purchase,and the balance is paid the following month. A 2% discount is allowed on purchases paid for in the month of purchase.

∙ Labor costs equal 20% of sales; other operating costs of $5,000 per month (including $2,000)of depreciation. Both are paid in the month incurred.

∙ The cash balance on October 1 is $4,300. A minimum cash balance of $4,000 is required at the end of the month. Money is borrowed in multiples of $1,000.

∙ The company will issue $6,000 of common stock and pay $10,000 in dividends in October.

∙ There is no debt outstanding at October 1.

Required:

Prepare a projected cash flow statement in good form for the month ended October 31.

Definitions:

Insurance Premium

The sum of money required to be paid by a person or company for obtaining an insurance coverage.

Risk-Averse

A description of an individual or entity that prefers to avoid risk, choosing safer options over potentially higher-reward alternatives.

Marginal Utility

The extra pleasure or benefit a person gains from consuming an additional unit of a product or service.

Risk Aversion

A preference for options with fewer risks and more predictable outcomes, often influencing investment and consumption behaviors.

Q1: Which of the following statements regarding the

Q35: Different products consume different proportions of manufacturing

Q45: If the Assembly Division sells 100,000 pairs

Q57: The demand for loanable funds curve<br>A)is horizontal.<br>B)has

Q66: Give two examples of financial information and

Q76: Sometimes qualitative factors are the most important

Q81: Strategy creates a competitive advantage by positioning

Q87: For an organization to be successful,activities within

Q95: When the nominal interest rate rises,the opportunity

Q127: When the operating budget is used as